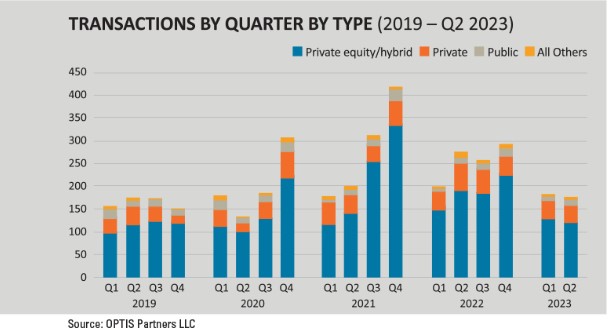

After record activity in 2021, the number of independent insurance agency and broker mergers & acquisitions returned to pre-pandemic levels in the first half of 2023, according to OPTIS Partners. The boom in activity between 2020 and 2021 was driven largely by a period of historically low interest rates and the attractiveness of investing in an agency or brokerage to create a predictable cash flow.

While an increase in the cost of borrowing has put the brakes on deal numbers and inflation has squeezed cash flows, many of the other circumstances that make the independent agency channel a sound and reachable investment remain.

Due to an aging demographic of owners, four in 10 agencies anticipate some ownership change in the next five years, with one-third planning changes in the next two years, according to the 2022 Agency Universe Study (AUS). Passing an independent agency to children or family members is still the most popular perpetuation plan, cited by 85% of agencies, but between 2020 and 2022, selling to an outside party rose from 17% to 20% as the next course of action, according to the AUS.

But most importantly, the private equity (PE)-fueled agent and broker M&A gold rush appears to be over. In the first half of 2023 there were less than 150 PE deals for two consecutive quarters for the first time in two years, according to OPTIS Partners, which is a significant decrease from the headiest days in 2021 where PE-backed deals surpassed 300 in the fourth quarter.

“Historically active buyers whose transaction count dropped below their five-year average included Acrisure LLC, which is focusing more on integrating its purchased business than making new deals,” according to OPTIS. “Also in this category are PCF Insurance Services and Baldwin Risk Partners LLC, both of which have largely suspended dealmaking for the time being.”

As the field clears for the runners and riders in the M&A race, the door is ajar for aspirational independent agency owners to make an acquisition that could change the trajectory of their business.

After the Gold Rush

“Now’s the time for agencies to make smart, strategic moves,” says Bradley Flowers (pictured above), founder of Portal Insurance in Mobile, Alabama, who, as a self-confessed novice in agency acquisitions, has made two acquisitions and has laid plans to make two more in the near future. After experiencing years of organic growth, Flowers started an acquisition strategy to “throw gasoline on that fire.”

Portal Insurance was founded in 2019 and writes business in Alabama, Mississippi, Georgia and Tennessee, specializing in personal lines and coastal risks, as well as some commercial habitational and trucking businesses. The agency has two locations and employs 13 team members.

The agency’s success relies on the coexistence of agency processes and technology. Earlier this year, Flowers hired a developer to design the agency’s systems, including a rater which is making remarketing easier in the current market.

“Our processes are set in stone—and they work,” Flowers says. “We try to make them as seamless and cookie-cutter as possible, so if something goes wrong, it sticks out like a sore thumb.”

Ultimately, this combination makes integrating acquisitions into Portal’s framework much simpler. However, the journey begins with identifying an agency to purchase, which includes an intake form on the agency website for interested sellers or partners.

Flowers’ acquisition strategy starts with his agency’s philosophy which is printed on a flag in the office entryway: “We’re not here to do what’s already been done.” Rather than searching for an already-successful agency, Flowers targets the fixer-upper end of the market.

“I look for opportunity,” Flowers explains. “If we can buy an agency that is somewhat stagnant or old school so to speak, doesn’t have a lot of technology, processes and systems, we can plug that agency into not only our backend processes and systems, but our marketing and sales initiatives, as well.”

“I’ve turned down agencies that were probably good buys, but there was no opportunity to make it more valuable,” he says. “Essentially, we’re buying real estate at 60 cents on the dollar because we can increase the value of that agency substantially.”

Further, this strategy supports Flowers’ mission to keep independent agencies in the independent agency channel. “I hate seeing local agencies get bought up by big firms, and then all of a sudden they’re not local anymore,” he says.

This cause adds another dimension to the appeal of selling to an aspirational agency like Flowers rather than a PE-backed broker.

In addition to looking to acquire an agency that has hit a ceiling and is open to a merger, “we look for agency owners who have built a legacy and want to leave it to someone that’s going to take care of it,” he says. “I tell agency owners all the time, ‘If you want to sell your agency and get top dollar, go sell to a PE firm. If you want to sell your agency and it to still have a soul, sell to me.'”

Acquiring … in this Economy?

Interest rate hikes are one of the reasons that deal activity has subsided. “It’s easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022,” according to Forbes Advisor, which notes that, “Once the Fed decided it was time to do something about inflation, it moved forcefully,” raising the federal rate of interest more than 5% in two years.

However, in the context of the last 25 years, a federal interest rate of around 5% is not unprecedented and shouldn’t be a dealbreaker for exploring an acquisition. “The cost of capital is fixed, so it’s a known quantity,” says Missy Kahl, partnerships director at Bickle Insurance in Athens, Ohio. “What you really need to factor in is what you learn from taking a deep dive into the agency.”

Prior to joining Bickle Insurance in May, Kahl spent 18 years with a regional carrier where she worked on numerous agency M&A transactions while a part of the carrier’s distribution team. During this time, she met the Bickle Insurance team. Since 2015, the agency has completed over 15 acquisitions, six of which have occurred within the last two years. Bickle hired Kahl to put a more strategic focus on their acquisition strategy and bring a culture-first approach to developing and executing acquisition and partnership opportunities.

“The cost of capital is more than it was, but the wrinkle is in the extra work,” she says. “As an acquirer, you need to do your due diligence.”

Many things go into doing your homework on an agency acquisitions target, such as culture fit, technology and carrier appointments, but due diligence will help an acquirer arrive at one all-important factor: cash flow. Determining cash flow is key to the price, as well as the loan amount and premium. However, cash flow cannot be identified without thoroughly reviewing the book of business.

Buyers can take a step toward determining cash flow by “getting under the covers and asking, ‘What is this seller’s book of business made up of?'” Kahl explains. “’Is it from a carrier that’s made recent changes where they’re not taking new business or they’re taking action on a certain line of business that might impact their value?'”

Go With the Flow

“Reliable, predictable cash flow is what’s being acquired in the acquisition,” says Scott Freiday, division director, InsurBanc. “However, higher interest rates and inflation means that it’s costing more to run a business, which means cash flow is impacted.”

But despite headwinds in the insurance market and wider economy, an acquisition is still “a great way to supercharge the business and grow revenue,” Freiday says, but only if it is “quality business” that is being purchased.

Here, the old adage “if you’ve met one independent agency then you’ve met one independent agency” rings true in assessing an agency’s book and cash flow. “No two agencies are the same and no dollar amount of revenue is going to generate the same profit, because it all depends on how the agency is being run and the type of business they’re writing,” Freiday says. “Revenue is not the best way to value agencies.”

Instead, EBITDA (earnings before interest, taxes, depreciation and amortization) is the gold standard for valuing an agency or its book of business, as well as the amount to pay for an agency, which is measured by multiples of EBITDA. If an agency makes between $3 million and $10 million in revenue and generates 15% consistent growth post-sale, it is not uncommon for an agency to receive a valuation of 15x plus EBITDA with an earn out opportunity, according to Reagan Consulting, which says that the typical agency purchase price EBITDA in 2022 was 12.5x.

However, unlike a simple revenue calculation, understanding EBITDA requires in-depth analysis of financial records. And for agencies that are seeking a loan to finance an acquisition, EBITDA is also crucial to confirm available cash flows to service debt.

Working with an industry bank can ensure that the debt-to-cash-flow ratio is manageable across a typical 7-10 year term. “We’re always going to make sure that there’s enough money being generated to run the daily operations and make sure that there’s enough money available to pay the overall debt load with some cushion involved,” Freiday says. “We’re not going to obstruct the agency from a cash flow perspective in order to make a transaction work.”

Further, given the unique nature of the independent agency universe and complicated nature of determining EBITDA and a purchase multiple, Freiday encourages bringing in an outside adviser or a consultant with independent agency expertise to help with the due diligence and valuation of a target, especially for smaller agencies that don’t have experience.

By the Book

An agency’s total value lies in the sum of the rest of its parts, which includes the building, IT systems and resources, staff and more, as well as the book of business. In this respect, selecting an agency to acquire depends on your needs. Flowers says one factor that led him to acquisitions was the talent shortage, while other agencies that feel their technology is lagging may use an acquisition to take a giant leap forward.

However, most of an agency’s value lies in its book of business. After all, that is what generates the much-vaunted cash flow. As a result, agencies may seek to purchase a book and overlook the rest of the assets.

Adam Bowe is the founder of Cake, an emerging InsurTech that is modernizing the book-buying process. The platform provides a marketplace for valuing, buying and selling books of business, as well as an online place for buyers to meet to discuss deals. The name derives from its key differentiator—the ability to “slice and dice a book of business,” Bowe says. “A book can be sold around carriers, lines of business and states.”

Bowe also points out that a book or fraction of a book purchase is an attractive option for buyers who missed the low interest rates from two years ago but have some capital burning a hole in their pocket. “You can either throw money at marketing, take the most aggressive form of growth—acquiring an entire agency—or buy a book of business that fits with your geography, niche or carrier appointments,” Bowe says.

Depending on the buyer’s strategy, a partial book purchase allows agents to reap various benefits, including meeting minimum business requirements and expanding into new geographies and markets. However, for the transaction, Cake is working to solve several other problems that acquirers face. First, discovery is “incredibly hard,” Bowe says. “If you go to any of the listing sites, there’s like maybe 15 listings on there.”

Second is valuation. “One of the things that we’re working on is a machine learning business valuation tool, so you can get a valuation of a book based on the rates Cake is seeing,” he says. “A core problem is that there’s this rumor mill around what valuations are. It’s like not knowing what your house is worth and not having Zillow to check it—we want to put that tool in front of both the buyers and the sellers.”

Flowers thinks that the independent agency channel is ripe for Cake’s innovation and, as an investor, has put his money where his mouth is. “We’re going to see a lot more of this type of thing,” Flowers says, who is noticing the trend accelerating by carrier exits and has had five agencies reach out offering to sell him their personal lines book.

Further, there are benefits on both sides of the deal, especially if the selling agency is being weighed down by a high-touch line of business that they don’t have the processes to handle. Also, “the seller gets an influx of cash that they can apply to other parts of their business,” Flowers says, referencing his appetite for quality personal lines business. “And the buyer gets a couple hundred thousand dollars to hit contingency.”

Roll With It

Among Best Practices agencies, independent insurance agency organic growth averaged 9.5% across all revenue categories, according to the 2023 Best Practices Study, and despite a reduction in buyers due to the pause in PE investment, values remain strong.

However, the endeavor shouldn’t be taken lightly. “It’s hard work,” says Gary Fischer, senior vice president, Liberty Mutual and Safeco Insurance. He has worked on operational integration in the independent agent and broker M&A space since 2000, working with Liberty Mutual on the Ohio Casualty and Safeco acquisitions, as well as niche PE independent agency acquisitions between 2008 and 2010.

“If you’re a retail agency that’s looking to buy, you have to be pretty intentional about putting the time in and getting the deal across the finish line, because they don’t happen quickly,” he says. “It’s a big shift from somebody who is good at selling insurance.” However, if you are up to the challenge, “there’s a lot of efficiencies to be gained.”

For example, when an agency changes ownership to an outside buyer, the new owner is faced with a book of business that is spread across a large number of carriers. “But an agency typically writes 80% of their business with their top three carriers,” Fischer explains. “That’s creating inefficiency, it’s dragging down EBITDA and there’s just waste in there.”

A book roll can solve these issues by taking business that isn’t written with the carriers that support the buyer’s strategy and moving them to one that is, while offering the insured a substitute policy with similar terms and premium.

“In personal lines, we’ve done over $1 billion in deals with agencies,” Fischer adds. “Book rolls are important in this space because, as agencies acquire, they generally end up with markets they don’t want.”

Rolling a book isn’t without its challenges, though. “Data collection is one of the biggest challenges with transferring books of business and typically, agents are burdened with most of this work,” says Heather Prabish, director of product management, Ivans®. “They need to run reports to identify the policies in the book and then provide details about the policies to the carrier. This process often involves pulling declarations pages and ACORD applications, running reports from their management system, or going to carrier portals to download this information.”

“After collecting, agencies then spend time copying and pasting this data into a location where it can be uploaded or transferred to the new carrier’s system. In worst cases, this information is often emailed—or printed and mailed,” she says.

Using Ivans Bookroll, a feature in Ivans Exchange that processes and gathers policy data for a book transfer, agencies can eliminate many of these issues for both agencies and carriers by allowing agencies to select from a list of policies that have been downloaded via the Ivans network and click a button to share that policy information with the new carrier. “Remember that policy collection process that used to take agencies literal days of their time?” Prabish asks. “Ivans allows them to do this same exercise within minutes.”

There are many ways an acquisition can be successful, whether it’s adding to your book, bringing in new producers or upgrading your technology, but finding the “right fit” is the name of the game.

“Ultimately, if you compare a well-run agency to one that is a super antiquated agency with no processes, no systems, no technology, nothing, we’re really looking for stuff right in the middle,” Flowers adds. “I don’t want it to be too far on the antiquated end of the scale, but I also don’t want it to be too far on the other. Otherwise, there’s no room to improve and add value.”

Will Jones is IA editor-in-chief.

| Red Flags The agency acquisition dating game relies on getting those all-important digits that reveal value and cash flow. But before you commit, you need to know what you’re getting yourself into. Here are eight red flags to look out for:1) Aggregator agreements. “I’ve had several deals blow up due to that agency being in some sort of aggregator agreement that either prevented them from selling or required me to join,” Flowers says. 2) Appointment dates. “Newer or short carrier appointments is something that might be a red flag,” Kahl says. “If you have a seller that has multiple carrier appointments but isn’t necessarily maximizing their revenue capacity with each one of those carrier appointments, it’s a concern.” 3) Agency fees. “Another thing I’ll look at is what type of fees they’re taking in, especially if they’re not in a coastal region,” Flowers says. “A little flag pops up and it’s like, ‘This might be a non-standard agency, and I’m not interested in that.'” 4) Culture. “We’ve done some acquisitions where it’s just a better feel and connection,” Kahl says. “We might have had other opportunities and worked with other potential buyers, but it really worked because we were able to see mutual commonalities with our culture— it can be the difference breaker in a deal.” 5) Data-message mismatch. “Make sure the data is matching the message that you’re getting from the owners in terms of growth, both in how they’re growing their business and how they plan to grow their business,” says Dana Pasquali, vice president of product management at Vertafore. “Those two things really need to match.” 6) Customer growth. “Right now, agencies are just tending to grow because premiums are increasing,” Kahl says. “But you want agencies that are not only showing revenue growth, but customer growth, as well.” 7) Purchase price. “I look at the purchase price versus the premium and revenue on the books and I weigh the equation of spending that amount of money on marketing,” Flowers says. “I’ve turned down some agencies because of that.” 8) Character of seller. “When selling insurance, it’s not a tangible product, it’s a promise to protect somebody in their worst time of need,” Kahl says. “You want somebody that represents their brand well in their market.”—WJ |

Recent Comments