Written By: Lauren Washington

Budgeting is the practice of trying to reasonably estimate a company’s future expenses and revenue streams so you can monitor the company’s financial health and make informed decisions. “When you set a budget, you are taking control of your future.” – Unknown

Budgeting does not need to be hard, and in this article we are going to do our best to simplify it for you. With a little time and consistency, a budget can be one of the most powerful tools you’ll ever have inside your agency. Let’s break it down!

Start with Goals

Creating a budget should start with a list of goals. Ask yourself, what are the long-term goals for the Agency? What will success look like in the near term? Make sure that the goals that you set are (SMART) Specific, Measurable, Achievable, Relevant, and Time-based. These goals will have an impact on your revenues and will also determine where you will need to allocate your resources in the next year. Your goals will help identify the specific areas that you want to invest in to ensure that you are making progress. Many agencies operate without a budget and instead rely on their gut instincts, or worse, have to wait until the end of the year to determine if the resources needed to invest in new tools or resources are available. Having a budget can provide you with greater clarity and allow you to act with confidence.

We realize that building a budget is not easy for everyone, so we have created a budgeting tool that can be used to help you build one for your agency. Download the budgeting tool here.

This tool is separated into several tabs that work together and are designed to simplify the budgeting process. On the first tab, you can categorize your expected expenses. Once these are entered there they will automatically fill in the “Expense” portion of the next tab, Annual Budget.

After adjusting and completing your Annual Budget tab, it will automatically break these expenses down by month in the Monthly tab. In this tab, you can fill in your actual revenue and expenses every month, and it will automatically compare them with the amounts you budgeted. The monthly income statements pull to the Annual tab, which provides an overview of how well you have maintained your budget during the year.

Here is an overview of the sections in the tool:

#1: Components of the Income Statement

Income statements are split into two major sections: Revenues and Expenses

Revenues can be further categorized into Commissions & Fees, Contingency/Bonus, and Other Income:

- Commissions & Fees: This category can include any revenue resulting directly from sales of insurance to Agency customers. This includes direct bill commissions, agency bill commissions, agency fee commissions, and any commissions received from insurance brokers. Only the agency’s portion of commissions and fees belong in this category. Any revenue collected in an Agency Bill situation that is to be remitted to a carrier should not appear on any part of the income statement because it is not owned by the Agency. This portion is collected and held in a Trust Account on the Balance sheet until it is remitted to the carrier.

When budgeting for Commission and Fee Revenue consider:

Expected renewal income. This should be based on last year’s performance, your agency’s retention rate, expected rate increases, and any other expected changes from carriers. Be sure to eliminate any polices that you know have been lost or by their nature are not expected to renew (for example bonds).

New Business

Include the new business you expect in the coming year based on the goals that you have set for your team.

- Contingency/Bonus: This category includes all contingency income received from carriers, and any bonus income received from a cluster/network/aggregator/alliance. It differs from Commission & Fees income from a budgeting standpoint, because, although it is an indirect result of sales, it is contingent upon your performance and the guidelines set by each carrier for new business production, retention, loss ratios and other factors. It can also be impacted by the performance of a network/aggregator/alliance that the agency is a member of. As you know, contingencies can vary and are not guaranteed. We strongly recommend that agencies do not include contingencies in their operating budget.

- Fee Income: Any fee income can be estimated based on the previous year performance as well as the goals for the upcoming year.

- Other Income: Oftentimes, Agencies will have revenue streams resulting from activities not related to the sale of insurance. For example, if the Agency owns their office building, they may have rental income.

Expenses are categorized into four categories: Payroll & Benefits, Selling Expenses, Operating Expenses, and Administration Expenses:

Payroll & Benefits:

Payroll: This category should contain any wages, commissions, salaries, and bonuses paid to the Agency’s owners/employees and any amounts paid to 1099 Employees (outside contractors). It should not contain any dividends paid to shareholders, which are considered administrative expenses.

Benefits: This category contains any expenses associated with employee benefits. It can include items such as retirement plans, employee insurance, and the employer portion of payroll tax expense (This does not include employee withholdings, which should not appear on the income statement.)

Selling Expenses: Selling expenses are expenses that result from efforts to make sales or retain customers. The most common categories in this section include marketing, promotions, advertising, travel, meals, and automobile expenses. It should not include expenses that are necessary for the day-to-day operations of the Agency. For example, although an office renovation may increase sales by improving customer experience, the main result of the renovation is not increased sales but providing a safe and effective work environment. A customer referral program, by contrast, increases sales directly. For this reason, the entertainment, meals, travel, and automobile expenses that should appear in this section are expenses directly associated with sales activities, not personal meals, travel, or vehicles.

Operating Expenses: Operating expenses are expenses incurred to ensure that the Agency can continue to operate effectively. Some common expenses included in this category include, rent, utilities, technology, licenses, business insurance, and professional services. For example, telephones are necessary in order to ensure that the Agency is able to contact clients, potential clients, and carriers. Therefore, telephone expenses can be considered operating expenses. However, personal cell phones should not be included in this expense if they are not used for business purposes (similar to automobile expenses, discussed above).

Administration Expenses: Administration expenses are expenses that cannot be directly attributed to the operation of the agency. For example, Officer Life Insurance (also known as Key-Person life insurance) is included in this category because this expense is not a result of the Agency’s efforts to sell insurance and is not necessary to maintain the day-to-day operations of the Agency. It also includes expenses like Depreciation, Amortization, Interest Expense, and Shareholder Distributions. In calculating EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), many (if not all) administrative income and expenses are removed or added back in that calculation.

#2: Projecting the Future

When budgeting for any business, it is important to estimate any increases/decreases in expenses, capture new expenditures that are expected in order to accomplish your stated goals as well as the estimated increases or decreased in revenue.

Typically, agency revenue cannot increase without agency expenses increasing as well. For example, your business plan for next year might be to increase Agency Commissions by 10%, but how are you going to achieve this goal? You will need to consider what amount of your current book of business you expect to retain. Remove any accounts that will not renew, like bonds for example. In addition, apply a reasonable assumption for your retention rate based on past performance. Then plan out how you will achieve that goal, for instance, you might need to hire a new producer, start a local ad campaign, or invest in a tool or technology to help create capacity on your team. When planning for revenue goals, keep in mind that revenue can also change due to circumstances like economic conditions, but these changes are harder to predict.

Changing circumstances can affect multiple parts of the income statement. For example, if a producer is retiring, this will decrease next year’s compensation expenses, but it will also decrease next year’s revenue. When making an adjustment to revenues or expenses, remember to consider how this circumstance may affect other parts of the income statement.

Sometimes the effects of changing circumstances can be hard to predict, such as the effects of local economic conditions. For example, if a large company opens up a new manufacturing facility in your area, it will likely improve the local economy, but it is hard to calculate the effect it will have on your Agency. In creating a budget for your Agency, it is better to only include increases in revenue when you can easily estimate them and when they have a fairly high likelihood of occurring.

Remember: Your Agency’s expected revenue will set the “tone” for your Agency’s expected expenses. Overestimating future revenue may result in overspending if you are not cautious.

#3: Use Reputable Information Sources

Ideally, estimates for specific expenses should draw on real data.

One method for estimating your future expenses is to obtain estimates directly from the business(es) you are expecting to purchase goods/services from. For example, the price of a new Agency Management Software can usually be obtained by either going to their website or by contacting the manufacturer directly. This is the ideal method for estimating expenses because it reflects the cost of the item right now.

Occasionally, a new expense may not have a “market price”, or the market price may be difficult or impossible to obtain. For example, you may be expecting to add a new producer, but are not sure how much you will have to pay them in their first year, and furthermore, you are not sure how it will affect your revenue. The best option in this case is to look at past data and use it as a benchmark. Historically, how much have you paid producers in their first year on average? How much revenue have new producers generated in their first year on average?

Once you have built your budget, be sure to share the goals and measurement metrics with your team. One of the benefits to establishing a budget is determining the key performance metrics that you can use to assess your overall and individual performance across the team. By mapping out the year, you can have well-defined metrics that you can use as a gauge all throughout the year. This oversight and management will allow you to adjust or pivot if something unexpected occurs or if a new opportunity arises.

Give the budgeting tool a try and let us know what you think!

“When you set a budget, you are taking control of your future.” – Unknown

Specific Instructions for Using the Excel Template

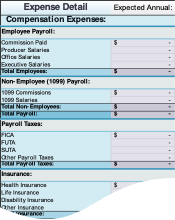

Tab 1: Expense Detail

This tab can be used to record your estimated expenses by item, so that they can more easily be transferred to the next tab, the annual Budget.

Each gray-colored heading (for example, Employee Payroll) represents an expense item that will be listed on your annual budget. Under each heading, you can enter your expected costs for various items to calculate the total for the line item.

These totals will automatically transfer to the Budget spreadsheet.

If you would prefer to skip this step, and calculate the expenses by category on your own, you can skip ahead to the budget spreadsheet.

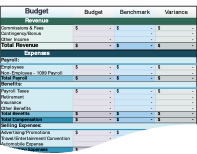

Tab 2: Budget

In the budget tab, your totals from the Expense Detail tab should automatically appear in the “Budget” column.

Next, you should enter your expected revenues in the revenue section of the Budget column.

If you chose not to use the Expense Detail tab, you should also enter your budgeted expenses manually on this sheet, in the Budget column.

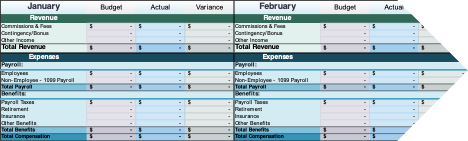

Tab 3: Monthly

In the monthly tab, your annual budget will automatically pull forward into each month’s “Budget” column. As each month passes, you can enter your actual revenues and expenses in the “Actual” column, and the “Variance” column will automatically tell you how much over/under your monthly budget you were.

Tab 4: Annual

In the annual tab, your actual monthly revenues/expenses will be added together and will automatically be compared with the amounts you budgeted.

For more information about planning for your agency please visit www.agency-focus.com or contact Carey Wallace at Carey@agency-focus.com.

About the Author:

Over the past 14 years, Carey Wallace has worked with hundreds of agencies helping them understand their agency’s value and turn that knowledge into an actionable plan for their agency’s future. Carey is a Certified Exit Planning Advisor, CEPA and provides a variety of consulting services through the company she founded, Agency Focus, LLC.

Recent Comments